How to Save Money While Keeping Your Sanity: Everyday Strategies

Every month the story repeats itself. The moment the salary arrives, it suddenly feels as if anything is affordable. Yet a week later, you are counting the days until the next paycheck and wondering where else you can cut expenses. Sound fa...

Author

Every month the story repeats itself. The moment the salary arrives, it suddenly feels as if anything is affordable. Yet a week later, you are counting the days until the next paycheck and wondering where else you can cut expenses. Sound familiar?

The tale is as old as time: a student like Amir, who spends everything on coffee, pastries, and taxis—and when the scholarship is delayed, turns to friends for loans. Many of us are a little like Amir. Or consider the family that spends half its income servicing loans, hoping tomorrow will be as stable as yesterday.

Spoiler: tomorrow may bring a crisis.

On the “Emergency Fund”

A person without financial reserves equal to 3–6 months of living expenses walks a tightrope without safety gear. One unexpected bill can be enough to push them into a debt spiral.

On the Credit Trap

“I live paycheck to paycheck, but I have a brand-new phone bought on credit” is not success—it is an illusion. Real success is when you become your own bank.

On Having a Dream

Saving for a holiday in Dubai is not about depriving yourself of everything. It is about being able, a year from now, to travel with a clear conscience and a full wallet—not on borrowed funds.

Everyone around us says, “You must save!” Meanwhile, our inner voice whispers: “You only live once,” “Inflation will eat it all,” “I already have enough to get by.”

This is our personal financial saboteur at work. Yet the paradox is this: the more modest the income, the more frightening the prospect of being left with nothing. A single unforeseen expense—a broken refrigerator, a sick relative—and you are caught in the trap of predatory microloans.

Step Zero: Escape the Debt Hamster Wheel

If you have a car loan, a mortgage, and an additional consumer loan “for home renovation,” then a significant portion of your income automatically disappears into debt payments. You become a hostage to your job. A sick leave or a layoff—and your entire financial system collapses.

The conclusion is simple: true financial independence begins not with a high income, but with living within your means and building reserves. Credit is a tool—not a philosophy of life.

Step 1: Build an Emergency Reserve — Your Financial Shield

Before dreaming of a new car, build your reserve. This is your lifeboat.

Size: at least three months of your actual living expenses, not income.

Where to keep it? Only in liquid and safe places:

- A savings account.

- A replenishable deposit with withdrawal options.

- A debit card with interest on the balance.

Keeping more than 10% of that sum as cash at home is essentially donating your money to inflation.

What is not an emergency fund:

- Stocks, cryptocurrency, bonds. If you urgently need money and your portfolio is down, will you sell at a loss? No.

- Credit cards. That is the bank’s money, not yours. A reserve must be entirely your own.

Step 2: Activate Autopilot — Let Technology Do the Work

The main enemy of savings is you and your “I’ll save whatever is left.” Outsmart yourself.

- Set up an automatic transfer to your savings account on the day you receive your salary. Start with 5–10%.

- Use “smart” banking tools: round-up features (paid 48.50? The extra 1.50 goes to savings automatically) or cashback redirected into a separate savings account.

The money leaves before you notice it—and your capital grows on autopilot.

Step 3: Turn Routine into a Game — Methods That Truly Work

Saving can be dull, but it can also feel like progressing through levels in a game. Here are proven methods:

“52 Weeks” Method

Our favorite.

Week 1 — save 1 manat,

Week 2 — save 2,

…

Week 52 — save 52.

Total after a year: 1,378 manats.

This is simply the sum of an arithmetic progression—mathematics, not magic.

“365 Days” Method

For the persistently dedicated.

Day 1 — 1 qəpik,

Day 2 — 2 qəpik…

Day 365 — 3.65 manats.

Total: 667.95 manats.

Savings Chart

Create or purchase a poster with amounts from 1 to 100 (or 365). Color in the amount you save each day. Visual progress helps sustain motivation.

The Envelope Method

Divide your monthly budget into categories (“food,” “transport,” “entertainment”) and place cash into envelopes. When an envelope is empty, spending in that category stops. Whatever remains at the end of the month becomes your added savings.

The Rule: “Pay Yourself First”

Upon receiving income, immediately set aside 10% for your savings. No debate. These are not leftovers—they are a priority expense: your future.

Remember: your brain is an excellent salesperson. It will insist that the next gadget is an “investment in productivity.” Do not fall for it. Real investment in yourself is acquiring skills that make you more valuable in the labor market—or building the safety cushion that protects you from panic.

Step 4: Learn to Spend Rationally

When your hand reaches for something attractive but unnecessary, ask yourself two questions:

- “If I were offered this item or its price in cash, which would I choose?”

If you would choose the money—walk away. - “Is this purchase more important than my financial security / my child’s education / a family vacation?”

Most often the answer is obvious.

What If You Barely Have Enough to Live On?

It happens. Then the plan becomes stricter:

- Tracking is power. Record all expenses. You will be surprised where the money goes (coffee to-go, unused subscriptions).

- Seek benefits and deductions. Make sure you receive all the support you are entitled to.

- Refinance expensive loans into one with a lower interest rate.

- Use cashback wisely. Get a card that returns money in the categories where you spend most.

- Most importantly: focus on increasing income—side jobs, freelancing, professional development. Sometimes this is the only healthy solution.

Financial Literacy Is Your Greatest Asset

Saving is not about stinginess. It is about respecting your own labor and time. It is about freedom of choice and peace of mind. It is about being able to say “no” to unfavorable conditions and “yes” to your real aspirations.

To not only save but also grow your capital wisely, you need systematic knowledge: how financial products work, how investments protect against inflation, and how to set realistic financial goals.

You do not need to begin with hundreds. Begin today.

Put 10 manats into a separate account.

This is your first step toward financial sovereignty.

Your future self will undoubtedly thank you.

-

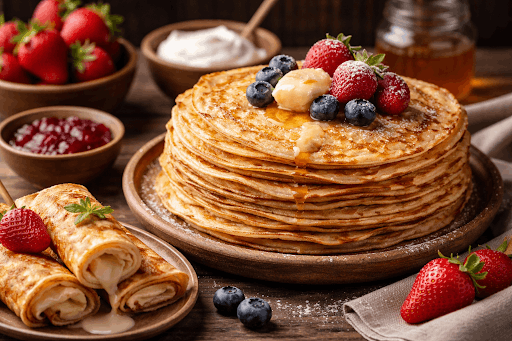

Culinary RecipesEveryone’s Favorite Pancakes: an Interesting History and a Classic Recipe

Culinary RecipesEveryone’s Favorite Pancakes: an Interesting History and a Classic Recipe<p dir="ltr"><span style="font-size: 18px;">A pancake lies on your plate—modest, golden, smelling of childhood and butter. Don’t be fooled...

23 Jan 2026, 11:24 -

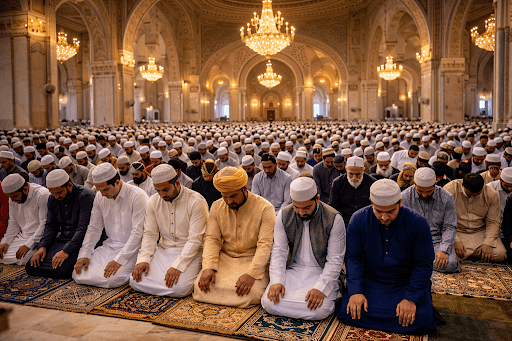

ReligionHoliday Prayer (Ṣalāt al-ʿĪd) in Islam: Structure, Symbolism, Significance

ReligionHoliday Prayer (Ṣalāt al-ʿĪd) in Islam: Structure, Symbolism, Significance<p dir="ltr"><span style="font-size: 18px;">There arrives that singular dawn when the air seems to vibrate with quiet joy. Cities and villages still s...

23 Jan 2026, 08:00 -

ReligionBeginning the Day with Worship: On the Morning Prayer

ReligionBeginning the Day with Worship: On the Morning Prayer<p dir="ltr"><span style="font-size: 18px;">Once, at the very break of dawn, when the world stood still in anticipation of the first ray of light, the...

23 Jan 2026, 06:48