Credit Debt: Your Personal Zombie Apocalypse — and How to Escape It with Dignity

Debt is not merely a set of payment schedules and interest rates; it is a series of continuous, subtle anxieties that quietly accompany each passing month. A credit card demands attention, an auto loan persistently reminds you of its existe...

Author

Debt is not merely a set of payment schedules and interest rates; it is a series of continuous, subtle anxieties that quietly accompany each passing month. A credit card demands attention, an auto loan persistently reminds you of its existence, and a mortgage, though seemingly passive, lies in the background like a heavy weight on your shoulders. In the end, you find yourself running in circles, trying to keep pace with everything at once.

Yet there is no need to panic—proven strategies exist that can help you regain control.

Common Situations Almost Everyone Encounters

Situation 1: Emotion Versus Mathematics

Many people begin by paying off their smallest debts first. This provides quick psychological relief: the list shortens, and a sense of progress emerges. However, it often becomes clear later that the total amount of interest paid ends up being higher than desirable.

Situation 2: A Rational Approach

Others prioritize the debts with the highest interest rates. This method is less emotionally gratifying and progress is less immediately visible, but it is in fact the most effective way to reduce the total amount of interest paid and save a substantial sum.

Situation 3: Legal Nuances

Collectors sometimes contact relatives about debts left behind by the deceased. It is crucial to remember that an individual becomes responsible for such debt only if they have formally accepted the inheritance. Without accepting the inheritance, there are no obligations—although this fact is often conveniently “forgotten.”

Take a deep breath. It is time to examine what can genuinely help.

Method 1: The “Snowball” Approach — Small Steps, Quick Victories

This method is ideal for those who enjoy lists and the sense of completion.

You write down all debts from the smallest to the largest. You make minimum payments on all of them, and direct any additional funds toward the smallest debt. Once it is eliminated, you move on to the next.

Advantages:

— Visible progress.

— Motivation grows as the number of “closed” items increases.

Disadvantages:

— It is often more expensive. While you focus on a small, low-interest debt, a larger, high-interest one continues accumulating significant interest.

Myth: Paying off small debts first is more cost-effective.

Reality: It is more cost-effective to pay off debts with the highest interest rates.

Method 2: Even Repayment — For Those Who Value Order

Here, no debt receives special treatment and emotions play no role.

You pay the minimum on all debts, then distribute the remaining funds equally among them.

Advantages:

— A strong sense of control without haste.

— An average level of savings: not the best, but not the worst.

Disadvantages:

— Lack of noticeable progress.

— May feel monotonous.

Method 3: The “Avalanche” Approach — Pure Logic and Maximum Benefit

You sort debts by interest rate—from the highest to the lowest. All available extra funds go toward the debt with the highest rate, while the rest receive minimum payments.

Advantages:

— Minimal total interest paid.

— The most rational, mathematically optimal approach.

Disadvantages:

— Not suitable for those who need “quick wins.”

— The first success may take time, especially if the highest-interest debt is substantial.

Using this method can save 15–20% compared to the “snowball” approach. This is your money—not the bank’s preference.

Method 4: Optimization — For Those Who Appreciate Spreadsheets and Precision

This is the most advanced strategy.

You build a model that accounts for interest rates, loan terms, prepayment penalties, and potential payment adjustments. Sometimes it turns out to be beneficial to pay a penalty or temporarily reduce payments on one loan in order to accelerate repayment of another.

Suitable for:

— Enthusiasts of Excel and detailed modeling.

— Those ready to consult a specialist.

— Borrowers with multiple loans seeking absolute optimization.

In most cases, the first three methods—especially the “avalanche” method—are perfectly sufficient.

If You Need Assistance — Legal Options Exist

Refinancing

A new loan at a lower interest rate replaces older ones. Fewer interest charges, less confusion. However, it is important not to fall into a new cycle of borrowing.

Restructuring

You can approach the bank and explain that your income has temporarily decreased. Banks sometimes agree to lower payments or extend the loan term.

Payment Holidays

A temporary pause in payments under certain conditions. This is not debt forgiveness, but it can provide real relief.

Personal Bankruptcy

A last resort. While debts may be discharged, strict limitations follow. This option should be considered only when absolutely no alternatives remain.

Which Strategy Should You Choose?

Need quick victories? — The Snowball Method.Prefer stability and order? — Even Repayment.

Want to save as much as possible? — The Avalanche Method.

Enjoy precision and detailed calculations? — Optimization.

Debt is neither a sentence nor the end of the world.

It is a solvable problem—gradually, thoughtfully, and systematically. The sooner you begin to act, the sooner the interest stops “ticking” at your expense.

-

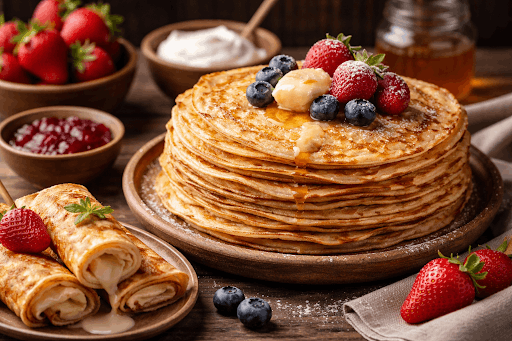

Culinary RecipesEveryone’s Favorite Pancakes: an Interesting History and a Classic Recipe

Culinary RecipesEveryone’s Favorite Pancakes: an Interesting History and a Classic Recipe<p dir="ltr"><span style="font-size: 18px;">A pancake lies on your plate—modest, golden, smelling of childhood and butter. Don’t be fooled...

23 Jan 2026, 11:24 -

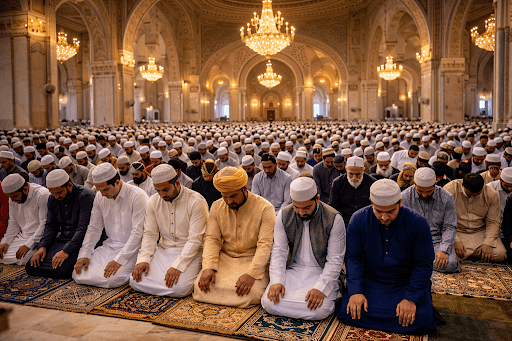

ReligionHoliday Prayer (Ṣalāt al-ʿĪd) in Islam: Structure, Symbolism, Significance

ReligionHoliday Prayer (Ṣalāt al-ʿĪd) in Islam: Structure, Symbolism, Significance<p dir="ltr"><span style="font-size: 18px;">There arrives that singular dawn when the air seems to vibrate with quiet joy. Cities and villages still s...

23 Jan 2026, 08:00 -

ReligionBeginning the Day with Worship: On the Morning Prayer

ReligionBeginning the Day with Worship: On the Morning Prayer<p dir="ltr"><span style="font-size: 18px;">Once, at the very break of dawn, when the world stood still in anticipation of the first ray of light, the...

23 Jan 2026, 06:48