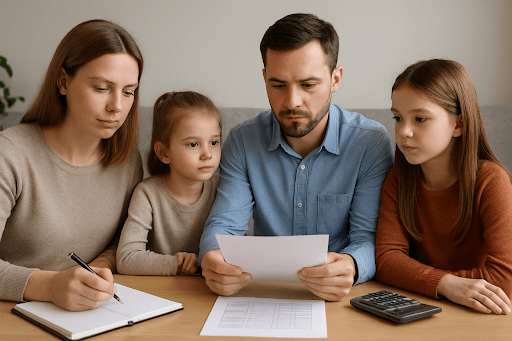

The Azerbaijani Family Budget: An Unvarnished Reality and a Guide to Survival

Do you remember the times when a single salary was sufficient to support an entire family, and there was always money in one’s wallet for a long-awaited vacation? Today, such stories sound like fairy tales meant for the exceptionally...

Author

Do you remember the times when a single salary was sufficient to support an entire family, and there was always money in one’s wallet for a long-awaited vacation? Today, such stories sound like fairy tales meant for the exceptionally naïve. The reality is that a simple trip to the grocery store has become a financial adventure, and every single manat demands careful accounting.

If you are ready to understand how we arrived at this point, let us examine the situation more closely.

The Arithmetic of Reality: How Much Does a “Normal” Life Cost?

Experts are largely unanimous: in order to sustain a family today, at least two adults must be employed. The era in which a single breadwinner could adequately provide for the entire household has irreversibly passed. Prices are rising faster than incomes, and the gap between the two is becoming increasingly tangible.

Official statistics attempt to instill optimism by reporting steady growth in public welfare. Yet, let us be candid: where statistics observe a “confident positive trend,” ordinary citizens perceive only a wallet that is perpetually emptying.

The State and Its Citizens: Parallel Realities

While families invent ever more creative ways to economize, the state proclaims social protection as a priority. Billions are allocated from the budget to support vulnerable segments of the population. This sounds impressive; however, for the average family, these funds amount to little more than a drop in the ocean of daily necessities.

Where Does the Money Go?

Let us examine the financial anatomy of an average Azerbaijani household. The picture is quite revealing:

- Food is the undisputed leader in household expenditures, consuming nearly half of the family budget.

- Utilities (electricity, gas, and water) occupy a firm second place. Bills rise month after month, giving the impression that they lead lives of their own—unlike salaries.

- Transportation represents a significant expense, particularly for those who must commute across the city for work.

- Clothing remains a necessary purchase, though increasingly families opt for more budget-friendly options.

- Health care: expenditures on medicines and medical services are growing at record rates. We fall ill from stress, yet treatment becomes ever more expensive.

- Harmful habits: paradoxically, while funds for quality food are often insufficient, money for cigarettes and alcohol is frequently found.

Education: Luxury or Necessity?

A separate and particularly sensitive issue concerns the cost of children’s education. Preparatory courses for university entrance in regional centers often cost sums comparable to several monthly salaries. Tutors charge fees so high that many parents are forced to deny themselves even basic necessities. In plain terms, this means that quality education is increasingly becoming a privilege of the few.

The Financial Labyrinth: How Not to Lose One’s Way

A Practical Guide

The irony of the situation lies in the fact that while some families struggle to make ends meet, others continue to spend money on questionable pleasures. While the state increases social benefits, individuals themselves do not always manage their resources rationally.

What, then, should an ordinary family do under such circumstances? Financial literacy experts propose not magical solutions, but concrete, practical steps.

1. Acknowledge the Problem and Choose a Model

Yes, life has become more expensive. The first step is to reach an agreement within the family on how money will be managed. Several models are possible:

- Joint budget: all income is pooled, and spouses decide together how to spend it.

- Mixed budget: part of the income is allocated to shared needs (housing, food, children), while the remainder is spent individually.

- Separate budget: each partner is responsible for specific expense categories (for example, one pays utilities, the other covers food and children’s education).

There is no ideal model; the key principles are honesty and mutual comfort.

2. Budget Planning: Knowing What Is Actually Happening

Begin with the simplest approach: for two or three months, meticulously record all income and expenditures. This includes not only major purchases, but also the small daily expenses of 5–10 AZN that quietly accumulate into significant sums. The goal is to see the real picture and identify areas for optimization. For instance, purchasing groceries once a week with a list at a hypermarket is often more economical than daily visits to an expensive neighborhood store.

3. Set Realistic Goals and Build a Safety Cushion

The objective is not “to become wealthy,” but “to learn how to distribute what one already has wisely.” Identify priorities: home renovation, a car, a child’s education. Calculate how much needs to be saved monthly and include this amount as a mandatory expense.

The most critical financial goal is an emergency fund—for illness, job loss, or urgent repairs. Aim to save 10–20% of income, even if you begin with a modest amount.

4. Discuss Finances to Preserve Harmony at Home

Money has become one of the main causes of family breakdowns, yet it can also serve as a unifying force. Regularly—once a month—sit down together and discuss the budget:

- What worked, and what did not?

- Who needs money, and for what, in the coming month?

- How can the family move closer to a major goal?

Transparency eliminates suspicion and fosters a sense of teamwork.

Conclusion: Between Reality and Hope

Managing a family budget in contemporary Azerbaijan is a complex puzzle that must be assembled anew each day. On one side are rising prices and chronic financial shortages; on the other, the necessity to plan, economize, and negotiate.

Yet it is precisely under such conditions that genuine practical wisdom emerges. Families learn to find alternative paths, to value what they have, and to remember that even in the most difficult financial circumstances, a systematic approach and an honest family dialogue create room for maneuver—and for humor. Because without a sense of humor, survival in this reality would be nearly impossible.

-

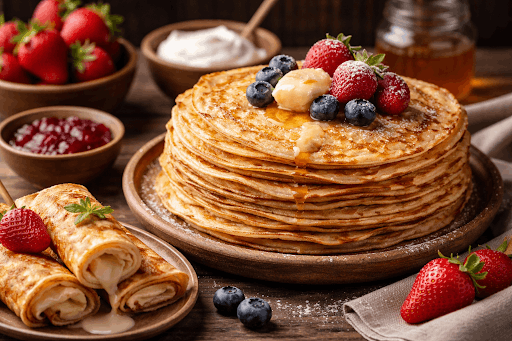

Culinary RecipesEveryone’s Favorite Pancakes: an Interesting History and a Classic Recipe

Culinary RecipesEveryone’s Favorite Pancakes: an Interesting History and a Classic Recipe<p dir="ltr"><span style="font-size: 18px;">A pancake lies on your plate—modest, golden, smelling of childhood and butter. Don’t be fooled...

23 Jan 2026, 11:24 -

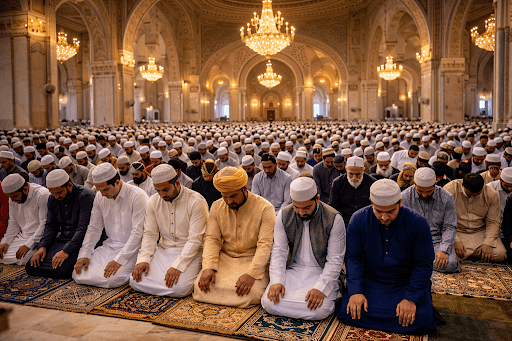

ReligionHoliday Prayer (Ṣalāt al-ʿĪd) in Islam: Structure, Symbolism, Significance

ReligionHoliday Prayer (Ṣalāt al-ʿĪd) in Islam: Structure, Symbolism, Significance<p dir="ltr"><span style="font-size: 18px;">There arrives that singular dawn when the air seems to vibrate with quiet joy. Cities and villages still s...

23 Jan 2026, 08:00 -

ReligionBeginning the Day with Worship: On the Morning Prayer

ReligionBeginning the Day with Worship: On the Morning Prayer<p dir="ltr"><span style="font-size: 18px;">Once, at the very break of dawn, when the world stood still in anticipation of the first ray of light, the...

23 Jan 2026, 06:48